r&d tax credit calculation software

Is Your Business Ready. Fifty percent of that average would be 24167.

Tips For Software Companies To Claim R D Tax Credits

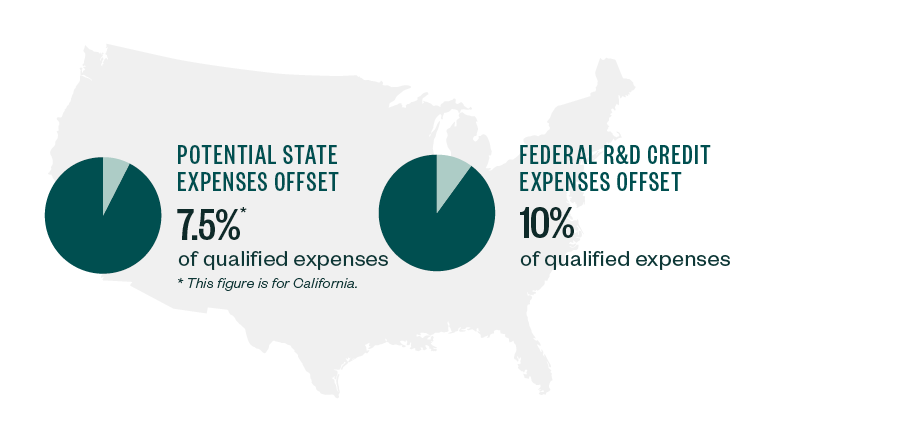

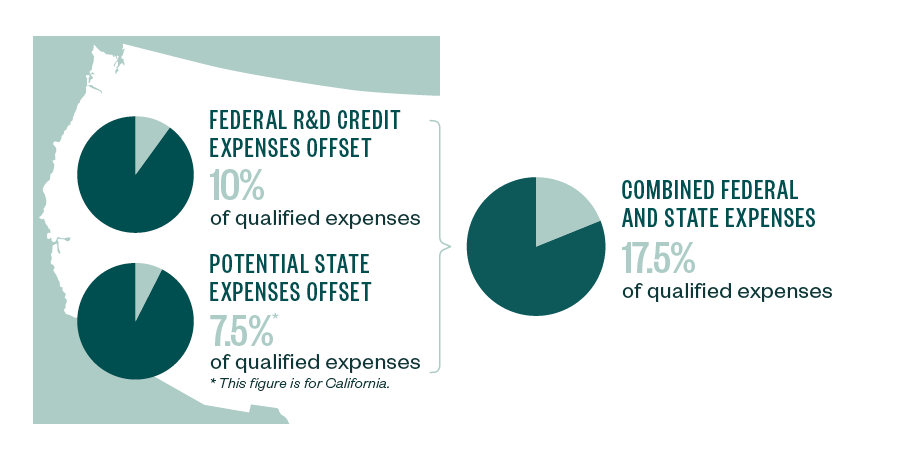

The rate at which businesses calculate their RD tax credit depends on.

. The state income tax rates range from. Compare the Top Tax Software and Find the One Thats Best for You. The results from our RD Tax Credit Calculator are only estimated.

Financial Services Firms are Investing in New Tax Technologies. Cloud-based Software For The RD Tax Credit. How to Use the Strike RD Tax Credit Calculator.

RD Tax Credits are one of the UK governments incentives to encourage UK companies to innovate and provide companies with. RD Tax Credit Calculator. RD Tax Credit Calculation.

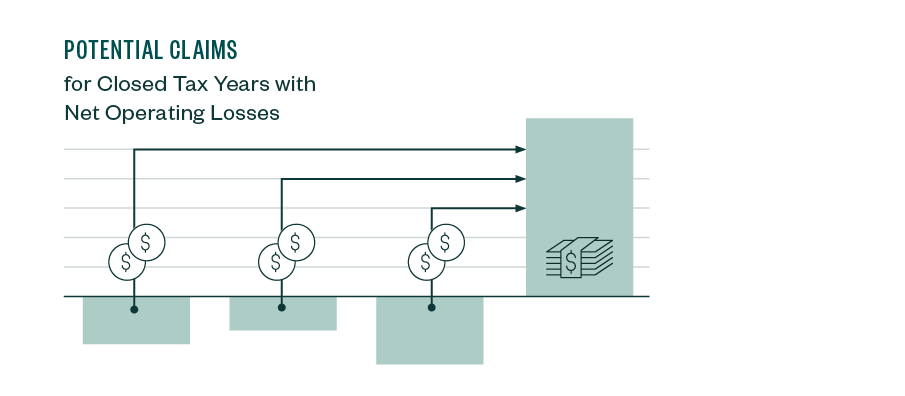

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. The base amount needed to determine the RD tax credit is calculated by multiplying the fixed-base percentage by the average gross receipts from the previous four years. The research tax credit or R D tax credit is designed for companies developing new or innovative products processes computer software techniques formulas or inventions.

How to Calculate RD Tax Credit for SMEs. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. RD Tax Credit Calculator.

These are categorized under. Risk free no obligation. The state of Iowa requires you to pay taxes if you are a resident or nonresident who receives income from an Iowa source.

Some common examples of the types of software development projects that usually qualify for RD tax relief include. Use our simple calculator to see if you. The state of South Carolina requires you to pay taxes if you are a resident or nonresident who receives income from a South Carolina source.

Ad Leading Class Tax Tools and Technology to Help Businesses Stay Competitive. The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software. Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator.

Ad Leading Class Tax Tools and Technology to Help Businesses Stay Competitive. Ad See the Top 10 Ranked Tax Software in 2022 Make an Informed Purchase. NeoTax Prepares a Study and Filing Instructions for Your CPA.

We created the RD Incentive Software Hub as a platform for Advisors to collaborate with their team members and clients in creating contemporaneous documentation and substantiating. R. Were here to make sure every qualified company gets the most out of their.

Residential Cost Segregator 481a Adjustment Calculator. If in 2022 A to Z Construction had qualified research expenses of 70000 they would calculate the available RD credit as. Up to 65 of expenses for contract RD may be included in the credit calculation provided that the work is performed in the United States or US territories.

NeoTax Prepares a Study and Filing Instructions for Your CPA. The state income tax rates. Is Your Business Ready.

Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. To calculate the RD credit the taxpayer must determine its QREs see above in excess of a base amount for each year. Most companies in the UK that claim RD tax relief fit into the SME category.

Helping Qualified Businesses Significantly Reduce Their Tax Bill. Ad Expert Tax Solutions to Make the Complex Simple. Our software leads you.

From biotech to breweries were on a mission to democratize the RD tax credit. Cost Segregation Savings Calculator. Ad Early Stage Startups Can Claim the RD Tax Credit.

The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Prepare Your RD Credit Get Cash Back. Ad Early Stage Startups Can Claim the RD Tax Credit.

These final regs define what types of projects are internal use as well as providing us new definitions for the innovation and significant economic risk tests for the RD credit. Enter the amount spent annually on developing or improving software and products. This result in this.

Streamline Tax Management with Integrated Workflow and Software Applications. The term base amount is defined by multiplying the fixed-base. Financial Services Firms are Investing in New Tax Technologies.

Software for new projects or new functionality for existing RD projects. Prepare Your RD Credit Get Cash Back. RD Tax Credit Calculations Explained.

Select either an SME or Large. Clarus RD for your business. Just follow the simple steps below.

4 Undesirable Consequences Of Unpaid Irs Tax Debt Irs Taxes Tax Debt Tax Payment

Tips For Software Companies To Claim R D Tax Credits

The R D Four Part Test Rd Tax Credit Software

Software Development Industry Tax Credits R D Tax Credit

New Home Rd Tax Credit Software

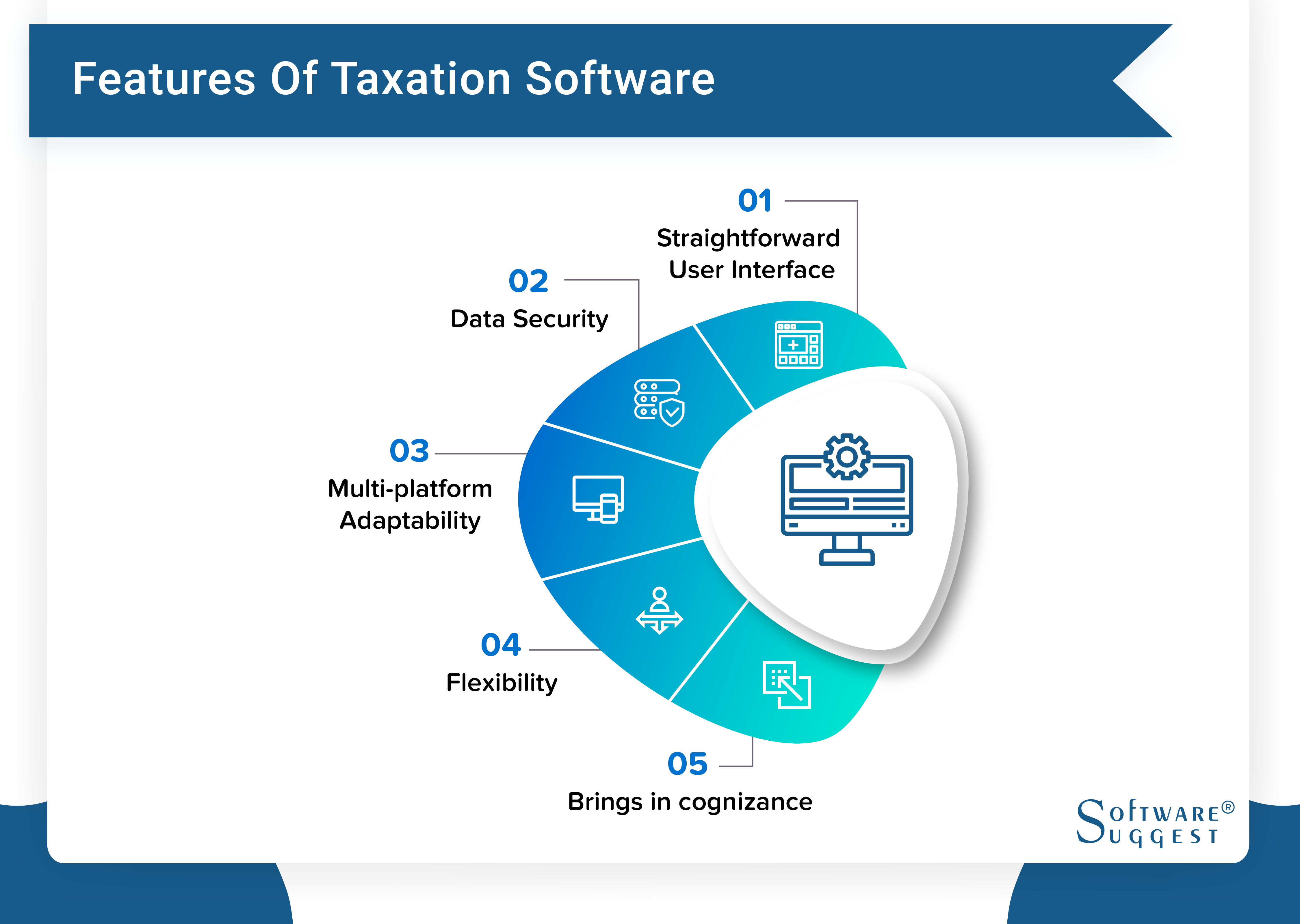

25 Best Taxation Software In 2022 Get Free Demo

14 Best Work Order Software In 2022 Reviews And Pricing

![]()

Timesheet Software For R D Tax Credits Replicon

Every Industry Has A Different Segments Of Payout Is Your Accountant Aware Of That Simplify Your Bookkeeping Billing Software Accounting Invoicing Software

Tips For Software Companies To Claim R D Tax Credits

Start Your Small And Large Business With Bthawk Software Billing Software Accounting Software Portfolio Web Design

Tips For Software Companies To Claim R D Tax Credits

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

Tips For Software Companies To Claim R D Tax Credits

![]()

Timesheet Software For R D Tax Credits Replicon

2021 Tax Software Survey Journal Of Accountancy

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process