long island tax rate

Taxing JurisdictionRateNew York state sales tax400Long Island City tax450Special. Whether you are already a resident or just considering moving to Long Island to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Long Island City sales tax rate is 45.

. The December 2020 total local. Currently the sales tax rate in Long Island City is 8875 percent. There is no applicable city tax or special tax.

There are approximately 21036 people living in. Get driving directions to this office. For tax rates in other cities see Kansas sales taxes by city and county.

The minimum combined 2022 sales tax rate for Long Island California is. The California sales tax rate is currently. What is the sales tax rate in Long Island California.

While the average effective property tax rate in Manhattan is just 088 and the statewide average rate is 169 Nassau County and Suffolk County average over 2 according to SmartAssetIt is important to note that property taxes provide the most. The first map below shows property tax averages for ZIP Codes on Long Island and the second map shows overall SALT levels. You would pay capital gains on that 300000 increase in property value at a 20 tax rate.

You can print a 7 sales tax table here. The New York sales tax rate is currently 4. Rules of Procedure PDF Information for Property Owners.

Real estate tax rates in New York are given in mills or millage rates. The deadline is before March 1 2019 so you need to file your grievance by then or you will need to wait until March 1 2020 before you can file a grievance covering the 2021 to 2022 tax year. There is no county tax that is applied.

For this reason those who live here will naturally have higher property assessment rates. The County sales tax rate is. Its no secret that Long Island property taxes are highIn fact New York City suburbs pay the highest taxes in the nation.

In Alaska the sales tax rate is 0 the sales tax rates in cities may differ from 0 to 7. The minimum combined 2022 sales tax rate for Long Island City New York is 888. The median property tax in New York is 375500 per year for a home worth the median value of 30600000.

This rate includes any state county city and local sales taxes. Based on latest data from the US Census Bureau. Simply get in touch with Gold Benes the premier flat rate tax grievance law firm in Nassau County.

Answer 1 of 3. But under Bidens tax plan individual long-term gains would increase from a 20 rate to a maximum rate of 396 on ordinary income. Long Island Maine 04050.

Average Property Tax Rate in Long Island. What is the sales tax rate in Long Island City New York. The Long Island sales tax rate is.

The median price of homes in Long Island is about 500000. The lowest rate applies to single and married taxpayers who file separate returns on incomes of up to 12000 as of 2020. In comparison the median price of homes across the USA is about 250000.

The December 2020 total local sales tax rate was. The latest sales tax rate for Long Island KS. Looking to reduce your Long Island property taxes.

This rate includes any state county city and local sales taxes. Long Island Property. In case none of the ways to help you pay property taxes work out you should look at real estate in other states.

Did South Dakota v. 2020 rates included for use while preparing your income tax deduction. Counties in New York collect an average of 123 of a propertys assesed fair market value as property tax per year.

Biden tax plan and real estate. The latest sales tax rate for Long Island City NY. Long Island City NY Sales Tax Rate.

Click on the maps for details. The Long Island City New York sales tax rate of 8875 applies to the following three zip codes. A mill is equal to 1 of tax for every 1000 in property value.

2020 rates included for use while preparing your income tax deduction. The current total local sales tax rate in Long Island City NY is 8875. I would refer to Newsday major metro NYC newspaper founded on Long Island for their average Nassau County tax rate chart for 2016.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. How to Challenge Your Assessment. Long Island is on the expensive side but various other options are available.

Method to calculate Long Island sales tax in 2021. Long Island Citys sales tax rate of 8875 percent is comprised of 4 percent New York state sales tax 45 percent Long Island City tax and 0375 percent Special tax for a total of 8875 percent. 207 766 5820 Phone 207 766 5400 Fax The Town of Long Island Tax Assessors Office is located in Long Island Maine.

Property Values Are Higher. The 7 sales tax rate in Long Island consists of 65 Kansas state sales tax and 05 Phillips County sales tax. Town of Long Island Selectmen - Assessors.

Assessment Challenge Forms Instructions. There are plenty of reasons to buy a home in Suffolk County which sits at the eastern end of Long Island - but low property taxes is not one of them. Nassau County Tax Lien Sale.

The County sales tax rate is 0. The typical Suffolk County homeowner pays 9157. Long Island school districts 2016-17 tax plans I grew up in.

This is the total of state county and city sales tax rates. Long Island KS Sales Tax Rate. This means that property values in Long Island are more than twice the national average.

Check out some of the states with low property tax rates. Also Nassau Suffolk counties. ZIP Codes with fewer.

The new top rate would apply only to people earning over 1 million per year. New York City has four tax brackets ranging from 3078 to 3876. Rates kick in at different income levels depending on your filing status.

New York has one of the highest average property tax rates in the country with only three states levying higher property. The Sales tax rates may differ depending on the type of purchase. The current total local sales tax rate in Long Island KS is 7000.

157 rows The average homeowners property tax bill in 89 of the 155 ZIP Codes on Long Island exceeds the 10000 limit for deductibility set in the new federal tax regulations. This is the total of state county and city sales tax rates. 11101 11109 and 11120.

Learn all about Long Island real estate tax.

Michigan Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

State Income Tax Rates Highest Lowest 2021 Changes

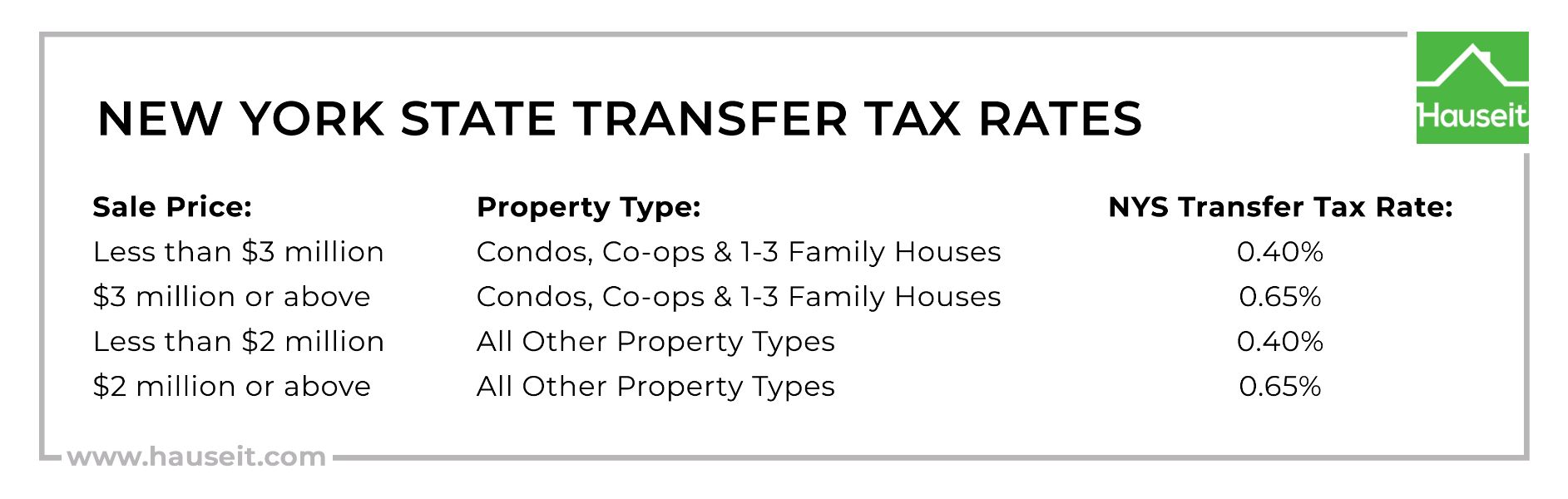

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

State Corporate Income Tax Rates And Brackets Tax Foundation

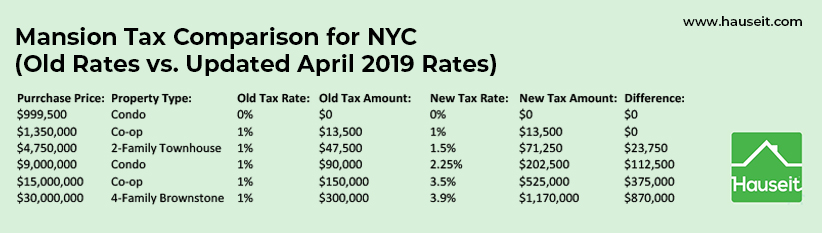

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

New York Paycheck Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

County Surcharge On General Excise And Use Tax Department Of Taxation

Hennepin County Mn Property Tax Calculator Smartasset

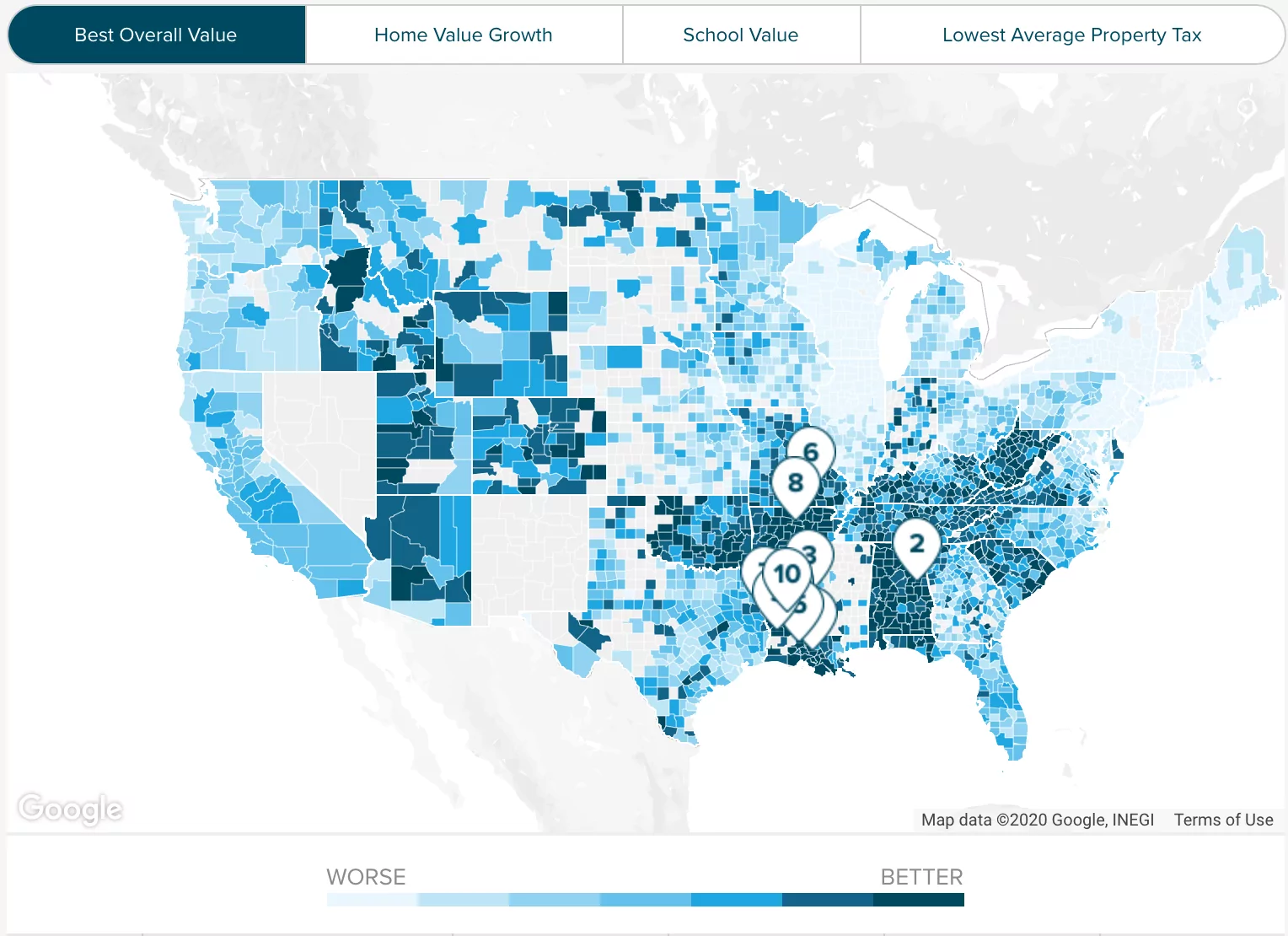

New York Property Tax Calculator Smartasset

/cdn.vox-cdn.com/uploads/chorus_asset/file/9870263/GettyImages-476961038.0.0.0.jpg)

I M An American Living In Sweden Here S Why I Came To Embrace The Higher Taxes Vox

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

What Are The Taxes On Selling A House In New York

What To Know Before Moving To Long Island

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times